How to draw money out of 401k

Table of Contents

Table of Contents

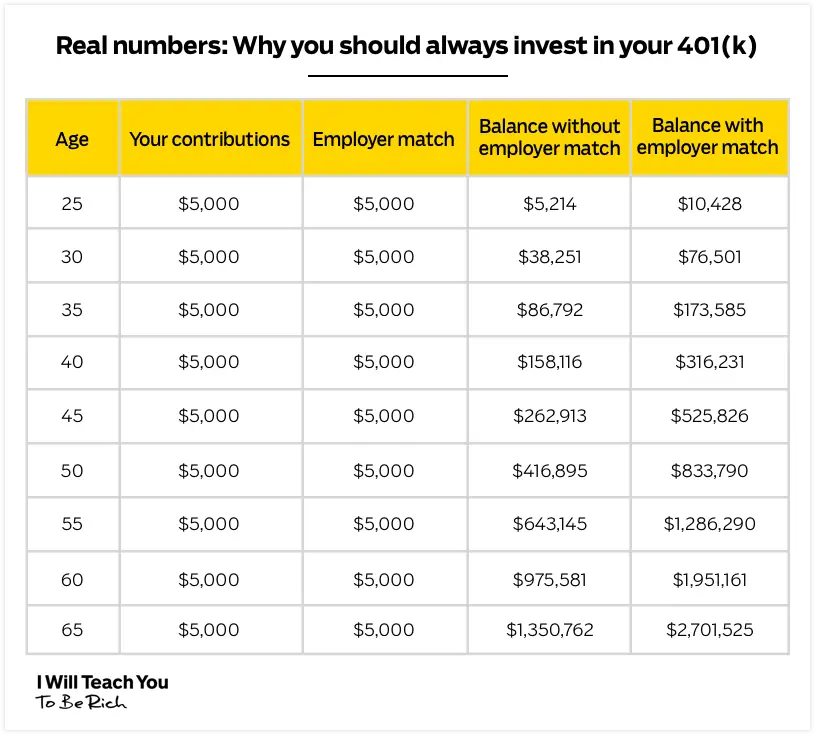

Are you looking to draw money out of your 401k? Most Americans have a 401k plan as their primary savings vehicle for retirement, but sometimes life circumstances can make us want to access that money before we reach retirement age. If you’re looking for a way to draw money out of your 401k, then you’ve come to the right place. In this article, we will guide you through the process of how to draw money out of your 401k.

Pain Points Related to Drawing Money Out of 401k

Before we dive into the specifics of drawing money out of a 401k plan, it’s essential to understand the pain points associated with this process. The primary concern for most individuals is the potential tax implications and penalties of drawing money out of a 401k account before the age of 59½. Others worry about the impact on their retirement savings and the consequences of withdrawing too much too soon.

How to Draw Money Out of Your 401k

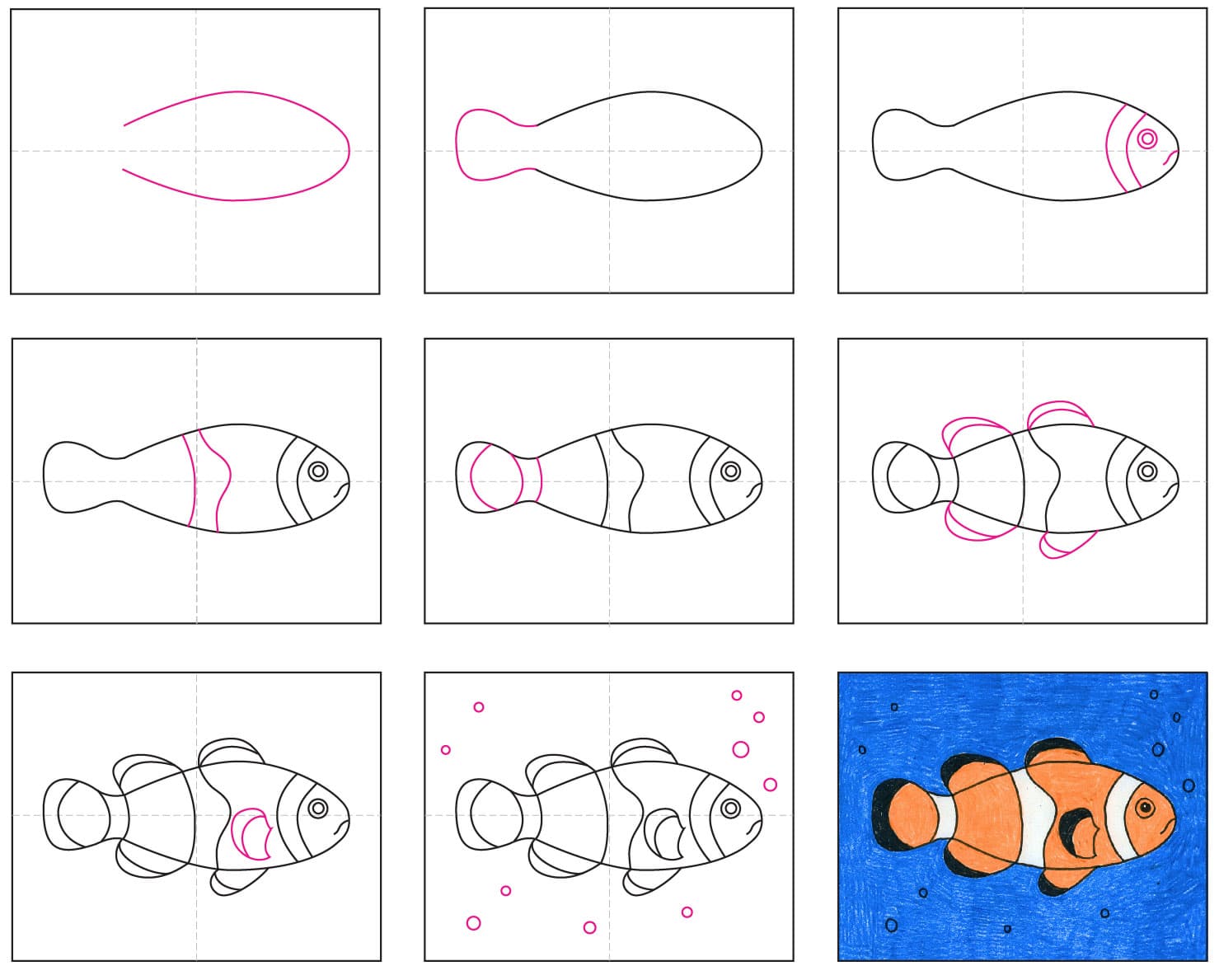

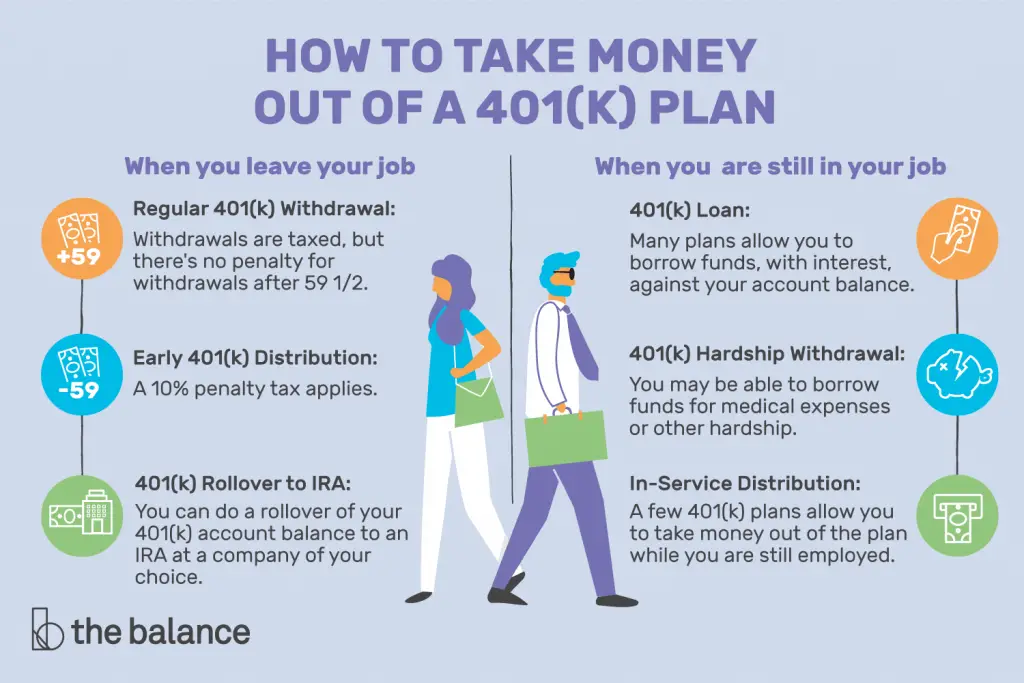

If you’re ready to access the funds in your 401k plan, there are several ways to do so. One of the most common ways is taking out a 401k loan, where you borrow a certain amount from your 401k and pay it back with interest. Another way is by making a hardship withdrawal, which allows you to take out money from your 401k due to specific circumstances, such as medical expenses, funeral costs, or home repairs.

If you’re no longer working for the employer that sponsored your 401k plan, you may be able to withdraw the entire balance of your account. However, keep in mind that any money you withdraw will be subject to income tax and, if you’re under 59½, a 10% early withdrawal penalty. You may be able to avoid the penalty if you qualify for specific exceptions, such as if you become disabled or if you use the money for certain medical expenses or higher education costs.

Summary of Main Points

In summary, there are several ways to draw money out of your 401k plan, including taking out a loan, making a hardship withdrawal, or cashing out the entire balance. Still, each option has different tax implications and penalties, which should be considered before making a decision.

Drawing Money Out of 401k: Personal Experience

When I had to access the funds in my 401k plan a few years ago, I opted for a 401k loan. While I knew that I would have to pay it back with interest, I felt that it was the most flexible option for me. I was able to use the money to purchase a new car, which wasn’t explicitly allowed under the hardship withdrawal criteria. One thing to keep in mind is that if you leave your job, the loan will be due in full within a specific time frame, which can be challenging if you don’t have the funds to pay it off immediately.

What to Consider when Drawing Money Out of 401k?

When drawing money out of your 401k plan, there are several factors to consider. First, evaluate your current financial situation and determine if taking out the funds is necessary. If it is, consider the tax implications and penalties of each option and choose the one that makes the most sense for your circumstances. Additionally, keep in mind the long-term impact of withdrawing from your retirement savings and try to limit the amount you withdraw, if possible.

The Tax Implications of Drawing Money Out of 401k

Depending on the type of withdrawal you make, drawing money out of your 401k plan can result in significant tax implications. If you withdraw the entire balance of your account in one lump sum, you will owe taxes on the total amount withdrawn. However, if you take out a 401k loan, you won’t have to pay taxes on the borrowed amount as long as you pay it back within the specified time frame.

Penalties for Drawing Money Out of 401k

If you’re under the age of 59½ and take out money from your 401k plan, you may also be subject to a 10% early withdrawal penalty in addition to income taxes. There are specific exceptions to this penalty, such as if you become disabled or if you use the money for higher education costs or to purchase a home.

Q&A for Drawing Money Out of 401k

Q: What happens if I can’t pay back my 401k loan?

A: If you can’t pay back your 401k loan on time, it will be considered a distribution and will be subject to income tax and potentially the 10% early withdrawal penalty if you’re under 59½.

Q: Can I withdraw funds from my old 401k account?

A: Yes, if you’re no longer working for the employer that sponsored your 401k plan, you may be able to withdraw the entire balance of your account, but you will be subject to income tax and potentially the 10% early withdrawal penalty.

Q: Can I take out a 401k loan to purchase a home?

A: Yes, you can take out a 401k loan to purchase your primary residence. However, keep in mind that you’ll have to pay back the loan with interest, and if you leave your job, the loan will be due in full within a specific time frame.

Q: Can I avoid taxes and penalties by rolling over my 401k funds into an IRA?

A: Yes, if you roll over your 401k funds into an IRA, you won’t be subject to taxes or penalties as long as you complete the rollover within 60 days and deposit the entire balance of your 401k account into the IRA.

Conclusion of Drawing Money Out of 401k

If you’re considering drawing money out of your 401k plan, it’s essential to weigh the pros and cons carefully. While it may be tempting to access your retirement savings, keep in mind the long-term impact on your financial future. Consider all of your options and consult with a financial advisor if necessary to make an informed decision.

Gallery

How Do I Get My 401k - 401kInfoClub.com

Photo Credit by: bing.com / 401k withdrawal laid attendancebot answered

How Do I Draw Money Out Of My 401k - 401kInfoClub.com

Photo Credit by: bing.com /

How Do I Draw Money Out Of My 401k - 401kInfoClub.com

Photo Credit by: bing.com /

How To Draw Money Out Of 401k - Draw Easy

Photo Credit by: bing.com / 401k withdraw

How To Draw Money Out Of 401k - Draw Easy

Photo Credit by: bing.com / 401k